Investor Charter

Peerless Securities Limited is a Company registered under the provisions of the Companies Act, 1956 with limited liabilities, having its registered office at "13A James Hickey Sarani - 2nd Floor, Kolkata 700069 and registered with Securities and Exchange Board of India as a Stock Broker and Depository Participant, thus a Securities Market Intermediary as per the various provisions enshrined in the relevant Acts of SEBI.

PSL Initiatives - Client Servicing & Grievance Redressal

At Peerless Securities Limited, we believe in offering the very best of products and ensuring high service standards. As part of this endeavour, we believe that investors should be able to contact us to offer comments on our products / services and also to address their grievances, if any. We earnestly value an investor’s feedback as it helps us review our present standards and improve upon them at every possible opportunity. The following are the various avenues for an investor to contact / write to us, depending on their convenience.

In order to facilitate investor awareness about various activities which an investor deals with such as opening of account, KYC and in person verification, complaint resolution, issuance of contract notes and various statements, process for dematerialization/rematerialization etc., PSL has prepared an Investor Charter detailing the services provided to Investors, Rights of Investors, various activities of PSL with timelines, DOs and DON’Ts for Investors and Grievance Redressal Mechanism.

Vision Statement

To follow highest standards of ethics and compliances while facilitating the trading by clients in securities in a fair and transparent manner, so as to contribute in creation of wealth for investors.

Mission Statement

- To provide high quality and dependable service through innovation, capacity enhancement and use of technology.

- To establish and maintain a relationship of trust and ethics with the investors.

- To observe highest standard of compliances and transparency.

- To always keep ‘protection of investors’ interest’ as goal while providing service.

- To ensure confidentiality of information shared by investors unless such information is required to be provided in furtherance of discharging legal obligations or investors have provided specific consent to share such information.

Services Provided To Investors

- Execution of trades on behalf of investors.

- Issuance of Contract Notes.

- Issuance of intimations regarding margin due payments.

- Facilitate execution of early pay-in obligation instructions.

- Periodic Settlement of client’s funds.

- Issuance of retention statement of funds at the time of settlement. .

- Risk management systems to mitigate operational and market risk.

- Facilitate client profile changes in the system as instructed by the client.

- Information sharing with the client w.r.t. relevant Market Infrastructure Institutions (MII) circulars.

- Redressal of Investor’s grievances.

- Provide a copy of Rights & Obligations document to the client. .

- Communicating Most Important terms and Conditions (MITC) to the client.

Rights Of Investors

- Ask for and receive information from a firm about the work history and background of the person handling your account, as well as information about the firm.

- Receive complete information about the risks, obligations, and costs of any investment before investing.

- Receive a copy of ‘Most Important Terms & Conditions’ (MITC).

- Receive a copy of all completed account forms and rights & obligation document.

- Receive account statements that are accurate and understandable.

- Understand the terms and conditions of transactions you undertake

- Access your funds in a timely manner and receive information about any restrictions or limitations on access.

- Receive complete information about maintenance or service charges, transaction or redemption fees, and penalties in form of tariff sheet.

- Discuss your grievances with compliance officer of the firm and receive prompt attention to and fair consideration of your concerns.

- Close your zero balance accounts online with minimal documentation.

- Get the copies of all policies (including Most Important Terms and Conditions) of the broker related to dealings of your account .

- Not be discriminated against in terms of services offered to equivalent clients .

- Get only those advertisement materials from the broker which adhere to Code of Advertisement norms in place.

- In case of broker defaults, be compensated from the Exchange Investor Protection Fund as per the norms in place .

- Trade in derivatives after submission of relevant financial documents to the broker subject to brokers’ adequate due diligence.

- Get warnings on the trading systems while placing orders in securities where surveillance measures are in place .

- Get access to products and services in a suitable manner even if differently abled .

- Get access to educational materials of the MIIs and brokers.

- Get access to all the exchanges of a particular segment you wish to deal with unless opted out specifically as per Broker norms .

- Deal with one or more stockbrokers of your choice without any compulsion of minimum business .

- Have access to the escalation matrix for communication with the broker .

- Not be bound by any clause prescribed by the Brokers which are contravening the Regulatory provisions. .

Various Activities With Timelines

| Sr. | No. Activities/ Services provided by PSL | Expected Timelines |

|---|---|---|

| 1 | KYC entered into KRA System and CKYCR | 3 working days of account opening |

| 2 | Client Onboarding | Immediate, but not later than one week |

| 3 | Order execution | Immediate on receipt of order, but not later than the same day |

| 4 | Allocation of Unique Client Code | Before trading |

| 5 | Copy of duly completed Client Registration Documents to clients | 7 days from the date of upload of Unique Client Code to the Exchange by the trading member |

| 6 | Issuance of contract notes | 24 hours of execution of trades |

| 7 | Collection of upfront margin from Client | Before initiation of trade |

| 8 | Issuance of intimations regarding other margin due payments | At the end of the T day |

| 9 | Settlement of client funds | First Friday/Saturday of the month / quarter as per Exchange preannounced schedule |

| 10 | ‘Statement of Accounts’ for Funds, Securities and Commodities | Monthly basis |

| 11 | Issuance of retention statement of funds/commodities | 5 days from the date of settlement |

| 12 | Issuance of Annual Global Statement | 30 days from the end of the financial year |

| 13 | Investor grievances redressal | 21 calendar days from the receipt of the complaint |

DOs And DON’Ts For Investors on Activities Provided

| DOs | DON’Ts |

|---|---|

| Read all documents and conditions being agreed before signing the account opening | Do not deal with unregistered stockbroker. |

| Receive a copy of KYC, copy of account opening documents and Unique Client Code. | Do not forget to strike off blanks in your account opening and KYC. |

| Read the product / operational framework / timelines related to various Trading and Clearing & Settlement processes. | Do not submit an incomplete account opening and KYC form. |

| Receive all information about brokerage, fees and other charges levied. | Do not forget to inform any change in information linked to trading account and obtain confirmation of updation in the system. |

| Register your mobile number and email ID in your trading, demat and bank accounts to get regular alerts on your transactions. | Do not transfer funds, for the purposes of trading to anyone other than a stock broker. No payment should be made in name of employee of stock broker. |

| If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. Before granting Power of Attorney, carefully examine the scope and implications of powers being granted. | Do not ignore any emails / SMSs received with regards to trades done, from the Stock Exchange and raise a concern, if discrepancy is observed. |

| Receive contract notes for trades executed, showing transaction price, brokerage, GST and STT etc. as applicable, separately, within 24 hours of execution of trades. | Do not opt for digital contracts, if not familiar with computers. |

| Receive funds and securities / commodities on time as prescribed by SEBI or exchange from time to time. | Do not share trading password. |

| Verify details of trades, contract notes and statement of account and approach relevant authority for any discrepancies. Verify trade details on the Exchange websites from the trade verification facility provided by the Exchanges. | Do not fall prey to fixed / guaranteed returns schemes. |

| Receive statement of accounts periodically. If opted for running account settlement, account has to be settled by the stock broker as per the option given by the client (Monthly or Quarterly). | Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits. |

| In case of any grievances, approach stock broker or Stock Exchange or SEBI for getting the same resolved within prescribed timelines. | Do not follow herd mentality for investments. Seek expert and professional advice for your investments. |

| Retain documents for trading activity as it helps in resolving disputes, if they arise. |

Additionally, Investors may refer to Dos and Don’ts issued by MIIs on their respective websites from time to time.

Grievance Redressal Mechanism

The process of investor grievance redressal is as follows:

| Sr.No. | Type of Activity | Activity |

|---|---|---|

| 1 | Investor complaint/Grievances |

Investor can lodge complaint/grievance against stock broker in the following ways: Mode of filing the complaint with stock broker Investor can approach the Stock Broker at the designated Investor Grievance e-mail ID of the stock broker. The Stock Broker will strive to redress the grievance immediately, but not later than 21 days of the receipt of the grievance

Mode of filing the complaint with stock exchanges

|

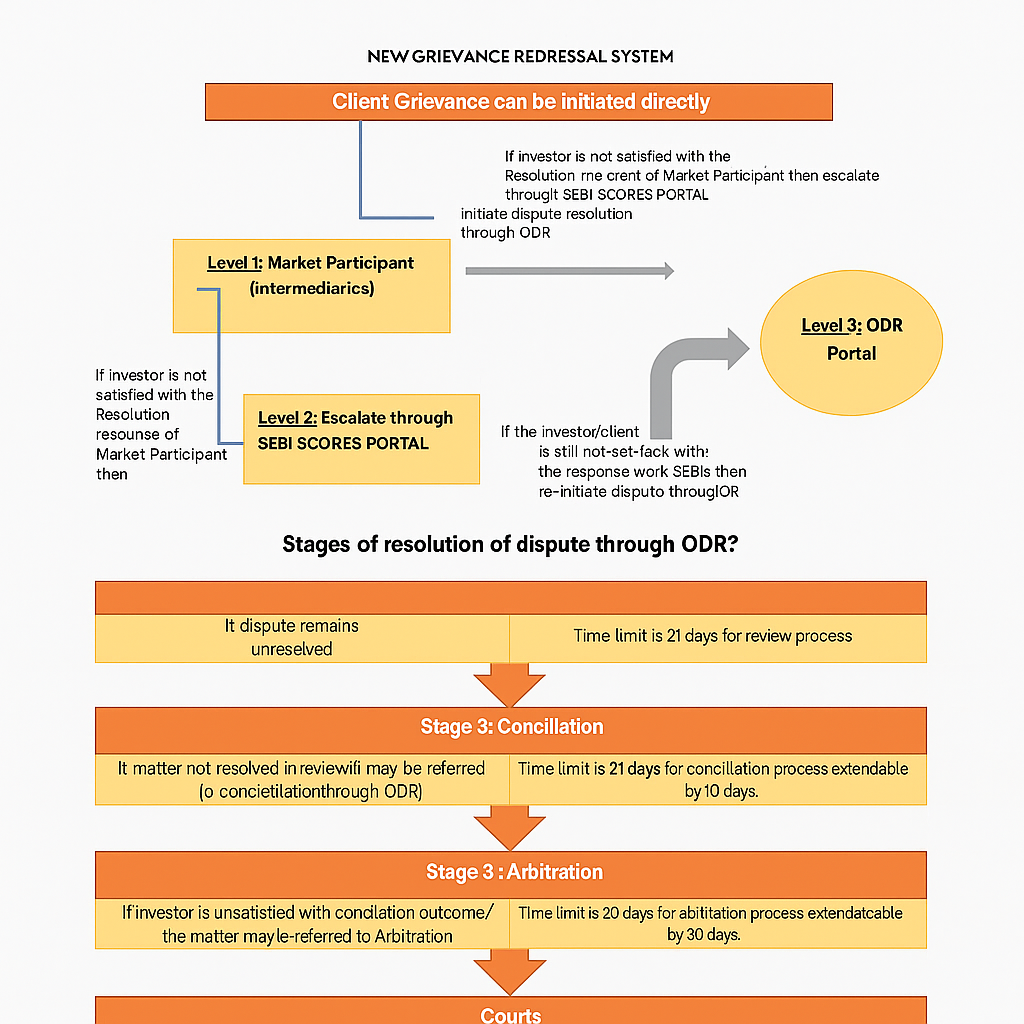

| 2 | Online Dispute Resolution (ODR) platform for online Conciliation and Arbitration. | If the Investor is not satisfied with the resolution provided by the Market Participants, then the Investor has the option to file the complaint/ grievance on SMARTODR platform for its resolution through online conciliation or arbitration. |

| 3 | Steps to be followed in ODR for Review, Conciliation and Arbitration |

|

Handling of Investor’s claims / complaints in case of default of a Trading Member / Clearing Member (TM/CM)

Default of TM/CM Following steps are carried out by Stock Exchange for benefit of investor, in case stock broker defaults:

- Circular is issued to inform about declaration of Stock Broker as Defaulter.

- Information of defaulter stock broker is disseminated on Stock Exchange website.

- Public Notice is issued informing declaration of a stock broker as defaulter and inviting claims within specified period.

- Intimation to clients of defaulter stock brokers via emails and SMS for facilitating lodging of claims within the specified period.

- Norms for eligibility of claims for compensation from IPF.

- Claim form for lodging claim against defaulter stock broker.

- FAQ on processing of investors’ claims against Defaulter stock broker.

- Provision to check online status of client’s claim.

- Standard Operating Procedure (SOP) for handling of Claims of Investors in the Cases of Default by Brokers

- Claim processing policy against Defaulter/Expelled members

- List of Defaulter/Expelled members and public notice issued

Vision Statement

Towards making Indian Securities Market - Transparent, Efficient, & Investor friendly by providing safe, reliable, transparent and trusted record keeping platform for investors to hold and transfer securities in dematerialized form.

Mission Statement

- To hold securities of investors in dematerialised form and facilitate its transfer, while ensuring safekeeping of securities and protecting interest of investors.

- To provide timely and accurate information to investors with regard to their holding and transfer of securities held by them.

- To provide the highest standards of investor education, investor awareness and timely services so as to enhance Investor Protection and create awareness about Investor Rights.

Details Of Business Transacted By The Depository And PSL As A Depository Participant (DP)

A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants - Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available in the link https://nsdl.co.in/dpsch.php

Description of Services Provided By The Depository through Depository Participant (DP) To Investors

(1) Basic Services:

| Sr. No. | Brief about the Activity / Service provided by SMIFS | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

| 1 | Dematerialization of securities | 7 days |

| 2 | Rematerialization of securities | 7 days |

| 3 | Mutual Fund Conversion | 5 days |

| 4 | Re-conversion of Mutual fund units | 7 days |

| 5 | Transmission of securities | 7 days |

| 6 | Registering pledge request | 15 days |

| 7 | Closure of demat account | 30 days |

| 8 | Settlement Instruction |

For T+1 day settlements, Participants shall accept instructions from the Clients, in physical form up to 4 p.m. (in case of electronic instructions up to 6.00 p.m.) on T day for payin of securities. For T+0-day settlements, Participants shall accept EPI instructions from the clients, till 11:00 AM on T day. Note: ‘T’ refers ‘Trade Day’ |

(2) Depositories provide special services like pledge, hypothecation, internet based services etc. in addition to their core services and these include:

| Sr. No. | Type of Activity /Service | Brief about the Activity / Service |

|---|---|---|

| 1 | Value Added Services |

Depositories also provide value added services such as

|

| 2 | Consolidated Account statement (CAS) | CAS is issued 10 days from the end of the month (if there were transactions in the previous month) or half yearly (if no transactions). |

| 3 | Digitalization of services provided by the depositories | Depositories offer below technology solutions and e-facilities to their demat account holders through DPs: |

Details of Grievance Redressal Mechanism

(1) The Process of Investor Grievance Redressal:

| 1 | Investor Complaint/ Grievances |

Investor can lodge complaint/ grievance against the Depository/DP in the following ways:

|

| 2 | Online Dispute Resolution (ODR) platform for online Conciliation and Arbitration | If the Investor is not satisfied with the resolution provided by DP or other Market Participants, then the Investor has the option to file the complaint / grievance on SMARTODR platform for its resolution through by online conciliation or arbitration. |

| 3 | Steps to be followed in ODR for Review, Conciliation and Arbitration |

|

(2) Illustration of New Grievance Redressal System: The flow-chart of New Grievance Redressal System

Guidance pertaining to special circumstances related to market activities: Termination of the Depository Participant

| Sr. No. | Type of special circumstances | Timelines for the Activity/ Service |

|---|---|---|

| 1 |

|

Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email. |

DOs and DON’Ts for Investors of PSL

| SI No. | Guidance |

|---|---|

| 1 | Always deal with a SEBI registered Depository Participant for opening a demat account. |

| 2 | Read all the documents carefully before signing them. |

| 3 | Before granting Power of attorney to operate your demat account to an intermediary like Stock Broker, Portfolio Management Services (PMS) etc., carefully examine the scope and implications of powers being granted. |

| 4 | Always make payments to registered intermediary using banking channels. No payment should be made in name of employee of intermediary. |

| 5 |

Accept the Delivery Instruction Slip (DIS) book from your DP only (pre-printed with a serial number along

with your Client ID) and keep it in safe custody and do not sign or issue blank or partially filled DIS slips. Always mention the details like ISIN, number of securities accurately. In case of any queries, please contact your DP or broker and it should be signed by all demat account holders. Strike out any blank space on the slip and Cancellations or corrections on the DIS should be initialed or signed by all the account holder(s). Do not leave your instruction slip book with anyone else. Do not sign blank DIS as it is equivalent to a bearer cheque. |

| 6 | Inform any change in your Personal Information (for example address or Bank Account details, email ID, Mobile number) linked to your demat account in the prescribed format and obtain confirmation of updation in system |

| 7 | Mention your Mobile Number and email ID in account opening form to receive SMS alerts and regular updates directly from depository. |

| 8 | Always ensure that the mobile number and email ID linked to your demat account are the same as provided at the time of account opening/updation. |

| 9 | Do not share password of your online trading and demat account with anyone. |

| 10 | Do not share One Time Password (OTP) received from banks, brokers, etc. These are meant to be used by you only. |

| 11 | Do not share login credentials of e-facilities provided by the depositories such as e-DIS/demat gateway, SPEED-e/easiest etc. with anyone else. |

| 12 | Demat is mandatory for any transfer of securities of Listed public limited companies. |

| 13 | If you have any grievance in respect of your demat account, please write to designated email IDs of depositories or you may lodge the same with SEBI online at https://scores.sebi.gov.in |

| 14 | Keep a record of documents signed, DIS issued and account statements received. |

| 15 | As Investors you are required to verify the transaction statement carefully for all debits and credits in your account. In case of any unauthorized debit or credit, inform the DP or your respective Depository. |

| 16 | Appoint a nominee to facilitate your heirs in obtaining the securities in your demat account, on completion of the necessary procedures. |

| 17 | Register for Depository's internet based facility or download mobile app of the depository to monitor your holdings. |

| 18 | Ensure that, both, your holding and transaction statements are received periodically as instructed to your DP. You are entitled to receive a transaction statement every month if you have any transactions. |

| 19 | Do not follow herd mentality for investments. Seek expert and professional advice for your investments. |

| 20 | Beware of assured/fixed returns. |

Rights of Investors of PSL

- Receive a copy of KYC, copy of account opening documents.

- No minimum balance is required to be maintained in a demat account.

- No charges are payable for opening of demat accounts.

- If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. You have the right to revoke any authorization given at any time.

- You can open more than one demat account in the same name with single DP/ multiple DPs.

- Receive statement of accounts periodically. In case of any discrepancies in statements, take up the same with the DP immediately. If the DP does not respond, take up the matter with the Depositories.

- Pledge and /or any other interest or encumbrance can be created on demat holdings.

- Right to give standing instructions with regard to the crediting of securities in demat account.

- Investor can exercise its right to freeze/defreeze his/her demat account or specific securities / specific quantity of securities in the account, maintained with the DP.

- In case of any grievances, Investor has right to approach Participant or Depository or SEBI for getting the same resolved within prescribed timelines.

- Every eligible investor shareholder has a right to cast its vote on various resolutions proposed by the companies for which Depositories have developed an internet based ‘e-Voting’ platform.

- Receive information about charges and fees. Any charges/tariff agreed upon shall not increase unless a notice in writing of not less than thirty days is given to the Investor.

- Right to indemnification for any loss caused due to the negligence of the Depository or the participant.

- Right to opt out of the Depository system in respect of any security.

Responsibilities of Investors of PSL

- Deal with a SEBI registered DP for opening demat account, KYC and Depository activities.

- Provide complete documents for account opening and KYC (Know Your Client). Fill all the required details in Account Opening Form / KYC form in own handwriting and cancel out the blanks.

- Read all documents and conditions being agreed before signing the account opening form.

- Accept the Delivery Instruction Slip (DIS) book from DP only (preprinted with a serial number along with client ID) and keep it in safe custody and do not sign or issue blank or partially filled DIS.

- Always mention the details like ISIN, number of securities accurately.

- Inform any change in information linked to demat account and obtain confirmation of updation in the system.

- Regularly verify balances and demat statement and reconcile with trades / transactions.

- Appoint nominee(s) to facilitate heirs in obtaining the securities in their demat account.

- Do not fall prey to fraudsters sending emails and SMSs luring to trade in stocks / securities promising huge profits.

Vision Statement

To drive trust, profitable growth, and pride of belonging, for delivering sustainable stakeholder value.

Mission Statement

To deliver value-added, technology driven services to the client while ensuring ethical and transparent business practices.

Details of business transacted by the Research Analyst with respect to the investors of PSL

- To publish research report based on the research activities of the RA.

- To provide an independent unbiased view on securities.

- To offer unbiased recommendation, disclosing the financial interests in recommended securities.

- To provide research recommendation, based on analysis of publicly available information and known observations.

- To conduct audit annually.

Details of services provided to investors of PSL (No Indicative Timelines)

- Onboarding of Clients.

-

Disclosure to Clients

- To distribute research reports and recommendations to the clients without discrimination.

- To maintain confidentiality w.r.t publication of the research report until made available in the public domain.

Responsibilities of Investors of PSL (DOs & DON’Ts)

-

DO’s

- Always deal with SEBI registered Research Analyst.

- Ensure that the Research Analyst has a valid registration certificate.

- Check for SEBI registration number.

-

Please refer to the list of all SEBI registered Research Analysts which is available on SEBI website in the following link:

(https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=14) - Always pay attention towards disclosures made in the research reports before investing.

- Pay your Research Analyst through banking channels only and maintain duly signed receipts mentioning the details of your payments.

- Before buying securities or applying in public offer, check for the research recommendation provided by your research Analyst.

- Ask all relevant questions and clear your doubts with your Research Analyst before acting on the recommendation.

- Inform SEBI about Research Analyst offering assured or guaranteed returns.

-

DON’Ts

- Do not provide funds for investment to the Research Analyst.

- Don’t fall prey to luring advertisements or market rumours.

- Do not get attracted to limited period discount or other incentive, gifts, etc. offered by Research Analyst.

- Do not share login credentials and password of your trading and demat accounts with the Research Analyst.

Investor Complaints Data

| SL | Received From | Carried forward from previous Month | Received during the Month | Total Pending | Resolved | Pending for less than 3months | Pending for more than 3months | Average Resolution on time (in Days) |

|---|---|---|---|---|---|---|---|---|

| 1 | Directly from Investor | NIL | 1 | NIL | 1 | NIL | NIL | NIL |

| A | Stock Broker | NIL | NIL | NIL | NIL | NIL | NIL | NIL |

| B | Depository Participant | NIL | NIL | NIL | NIL | NIL | NIL | NIL |

| C | Research Analyst | NIL | NIL | NIL | NIL | NIL | NIL | NIL |

| 2 | SEBI (SCORES 2.0) | NIL | 1 | 1 | NIL | NIL | NIL | NIL |

| 3 | Stock Exchange | NIL | NIL | NIL | NIL | NIL | NIL | NIL |

| 4 | Depository | NIL | NIL | NIL | NIL | NIL | NIL | NIL |

| 5 | Other Sources (if any) | NIL | NIL | NIL | NIL | NIL | NIL | NIL |

| Grand Total | NIL | 2 | 1 | 1 | NIL | NIL | NIL |

| SL | Month | Carried forward from Previous Month | Received | Resolved | Pending |

|---|---|---|---|---|---|

| 01. | Feb 2025 | 4 | 0 | 0 | 4 |

| 02. | Mar 2025 | 4 | 0 | 0 | 4 |

| 03. | Apr 2025 | 4 | 0 | 0 | 4 |

| 04. | May 2025 | 4 | 1 | 1 | 4 |

| 05. | June 2025 | 4 | 0 | 0 | 4 |

| 06. | July 2025 | 4 | 0 | 0 | 4 |

| 07. | Aug 2025 | 4 | 0 | 0 | 4 |

| 08. | Sep 2025 | 4 | 1 | 0 | 5 |

| 09. | Oct 2025 | 5 | 1 | 1 | 5 |

| 10. | Nov 2025 | 5 | 1 | 1 | 5 |

| 11. | Dec 2025 | 5 | 0 | 0 | 5 |

| 12. | Jan 2026 | 5 | 0 | 0 | 5 |

| SL | Year | Carried forward from Previous Year | Received during the Year | Resolved during the Year | Pending at the end of the Year |

|---|---|---|---|---|---|

| 1 | 2017-2018 | 2 | 9 | 7 | 4 |

| 2 | 2018-2019 | 4 | 6 | 5 | 5 |

| 3 | 2019-2020 | 5 | 2 | 3 | 4 |

| 4 | 2020-2021 | 4 | 3 | 3 | 4 |

| 5 | 2021-2022 | 4 | 2 | 4 | 2 |

| 6 | 2022-2023 | 2 | 7 | 7 | 2 |

| 7 | 2023-2024 | 2 | 2 | 0 | 4 |

| 8 | 2024-2025 | 2 | 2 | 0 | 4 |

Escalation Matrix

We are listening! Your concerns are most important to us. To ensure your grievance has been properly looked after, we have created a 4 tier query resolution and grievance redressal procedure.

| Details | Name | Tel No. | Working Hours | Address | |

| Customer Care | Mr. Sayantan Basu | pslrelations@peerlesssec.com | 033 4050 2713 | 9:00 am to 5:00 pm (Mon to Sat *) | 13A James Hickey Sarani - 2nd Floor, Kolkata-69 |

| Compliance Officer | Mr. Suryasis Sarcar | compliance@peerlesssec.com | 033 4050 2712 | 9:00 am to 5:00 pm (Mon to Sat *) | 13A James Hickey Sarani - 2nd Floor, Kolkata-69 |

| VP | Mr. Mrinal Basak | principalofficer@peerlesssec.com | 033 4050 2726 | 9:00 am to 5:00 pm (Mon to Sat *) | 13A James Hickey Sarani - 2nd Floor, Kolkata-69 |

| Wholetime Director | Mr. Kanchan Chaudhuri | kanchan.chaudhari@peerlesssec.com | 033 4050 2734 | 9:00 am to 5:00 pm (Mon to Sat *) | 13A James Hickey Sarani - 2nd Floor, Kolkata-69 |

* Saturday timings: 10:30 am - 3:30 pm on all Saturdays except 3rd Saturday.

In absence of response/complaint not addressed to your satisfaction, you may lodge a complaint with SEBI at https://scores.sebi.gov.in or Investors may also register their Complaints in SMARTODR Portal at https://smartodr.in/login for online dispute resolution.

Grievance Redressal Mechanism

Level 1 – Investors may write their query/complaint to the customer care at pslrelations@perlesssec.com.

Level 2 – If an investor’s communication was a complaint and they are not satisfied with the Customer Care they may write to the Compliance Officer – Mr. Suryasis Sarcar, at compliance@perlesssec.com.

Level 3 – If an investor is not satisfied with the resolution they received from the Compliance Officer, in that case they may write to the Vice President - Mr. Mrinal Kumar Basak at principalofficer@perlesssec.com.

Level 4 – If an investor is still not satisfied with the resolution then they may write to the Wholetime Director – Mr. Kanchan Chaudhuri at the designated Investor Grievance E-mail Id – kanchan.chaudhuri@perlesssec.com.

PSL will strive to redress the grievance immediately, but not later than 30 days of the receipt of the grievance.

Level 5 – Approach the Stock Exchange using the grievance mechanism mentioned at the website of the respective Exchange.

Filing Complaints on SCORES OR SMARTODR - Easy & Quick

Investors can expedite Grievance Resolution by registering their Complaints with SEBI at https://scores.gov.in or they may also write to any of the offices of SEBI. For any queries, feedback or assistance, please contact SEBI Office on Toll Free Helpline at 1800 22 7575 / 1800 266 7575. Investors may also register their Complaints in SMARTODR Portal at https://smartodr.in/login for online dispute resolution.For further information, investors may refer SEBI master circular on Online Dispute Resolution.- Register on SCORES portal

-

Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, Email ID

-

Benefits

- Effective communication

- Speedy redressal of the grievances

Contact Details of the concerned Stock Exchange(s) / Depository(s):

| Exchange | Web Address | Contact No | Email-id |

|---|---|---|---|

| BSE | https://bseindia.com | (91 22) 2272 8517/8097 | dis@bseindia.com |

| NSE | https://nseindia.com | (91 22) 2659 8190/91/1800 266 058 | ignse@nse.co.in |

| MCX | https://mcxindia.com | (91 22) 6649 4070 | grievance@mcxindia.com |

| Depository | Web Address | Contact No | Email-id |

| NSDL | https://nsdl.co.in | (91 22) 2499 4200 | relations@nsdl.co.in |

Grievance Redressal Through SEBI

| Address of SEBI Office | Contact Person : Telephone Nos. | Contact E-mail ID |

|---|---|---|

|

SEBI - Head Office : Sebi Bhavan, Plot No. C4-4, “G” Block, Bandra Kurla Complex, Bandra East, Mumbai - 400 051 |

Deputy General Manager (DGM) (91 22) 2644 9000/4045 9000 |

iggc@sebi.gov.in sebi@sebi.gov.in |

|

SEBI - Northern Regional Office : 5th Floor, Bank of Baroda Building, 16, Sansad Marg, New Delhi - 110 001 |

Deputy General Manager (DGM) (91 11) 2372 4001-05 |

sebinro@sebi.gov.in |

|

SEBI - Eastern Regional Office : L&T Chambers, 3rd Floor, 16, Camac Street, Kolkata - 700 016 |

Deputy General Manager (DGM) (91 33) 2302 3000 |

sebiero@sebi.gov.in |

|

SEBI - Southern Regional Office : 7th Floor, 756-L, Anna Salai Chennai - 600 002, Tamil Nadu |

Deputy General Manager (DGM) (91 44) 2888 0222 / 2852 6686 |

sebisro@sebi.gov.in |

|

SEBI - Western Regional Office : SEBI Bhavan,Panchvati, 1st Lane Gulbai Tekra Road, Ahmedabad - 380 006, Gujarat |

Deputy General Manager (DGM) (91 79) 2658 3633-35 |

sebiwro@sebi.gov.in |

Investor Charter of Stock Exchange & Depository

|

Investor Charter | NSDL | View Details |

|

Investor Charter | NSE | View Details |

|

Investor Charter | BSE | View Details |

|

Investor Charter | SEBI | View Details |

| SL | Date | Day | Description |

| 1 | 26-Feb-2025 | Wednesday | Mahashivratri |

| 2 | 14-Mar-2025 | Friday | Holi |

| 3 | 31-Mar-2025 | Monday | Id-Ul-Fitr (Ramadan Eid) |

| 4 | 10-Apr-2025 | Thursday | Shri Mahavir Jayanti |

| 5 | 14-Apr-2025 | Monday | Dr. Baba Saheb Ambedkar Jayanti |

| 6 | 18-Apr-2025 | Friday | Good Friday |

| 7 | 01-May-2025 | Thursday | May Day |

| 8 | 15-Aug-2025 | Friday | Independence Day |

| 9 | 27-Aug-2025 | Wednesday | Ganesh Chaturthi |

| 10 | 02-Oct-2025 | Thursday | Mahatma Gandhi Jayanti / Dussehra |

| 11 | 21-Oct-2025 | Tuesday | Diwali Lakshmi Puja |

| 12 | 22-Oct-2025 | Wednesday | Diwali / Balipratipada |

| 13 | 05-Nov-2025 | Wednesday | Gurunanak Jayanti |

| 14 | 25-Dec-2025 | Thursday | Christmas |

The holidays falling on Saturday / Sunday are as follows:

| SL | Date | Day | Description |

| 1 | 26-Jan-2025 | Sunday | Republic Day |

| 2 | 06-Apr-2025 | Sunday | Shri Ram Navami |

| 3 | 07-Jun-2025 | Saturday | Bakri Eid |

| 4 | 06-Jul-2025 | Sunday | Muharram |

Market Timings:

Trading on the equities segment takes place on all days of the week (except Saturdays and Sundays and holidays declared by the Exchange in advance). The market timings of the equities segment are:- A) Pre-open session

- Order entry & modification Open: 09:00 hrs

- Order entry & modification Close: 09:08 hrs*

- *with random closure in last one minute. Pre-open order matching starts immediately after close of pre-open order entry.

- B) Regular trading session

- Normal / Limited Physical Market Open: 09:15 hrs

- Normal / Limited Physical Market Close: 15:30 hrs

- C) Closing Session

- The Closing Session is held between 15.40 hrs and 16.00 hrs

- D) Block Deal Session Timings:

- Morning Window: This window shall operate between 08:45 AM to 09:00 AM.

- Afternoon Window: This window shall operate between 02:05 PM to 2:20 PM.

- Note:

- The Exchange may, however, close the market on days other than the above schedule holidays or may open the market on days originally declared as holidays. The Exchange may also extend, advance or reduce trading hours when its deems fit and necessary.

| SL | Date | Day | Description | Morning Session | Evening Session* |

| 1 | 1-Jan-2025 | Wednesday | New Year | Open | Closed |

| 2 | 26-Feb-2025 | Wednesday | Maha Shiv Ratri | Closed | Open |

| 3 | 14-Mar-2025 | Friday | Holi | Closed | Open |

| 4 | 31-Mar-2025 | Monday | Eid-ul-Fitr | Closed | Open |

| 5 | 10-Apr-2025 | Thursday | Mahavir Jayanti | Closed | Open |

| 6 | 14-Apr-2025 | Monday | Dr. Baba Saheb Ambedkar Jayanti | Closed | Open |

| 7 | 18-Apr-2025 | Friday | Good Friday | Closed | Closed |

| 8 | 01-May-2025 | Thursday | May Day | Closed | Open |

| 9 | 15-Aug-2025 | Friday | Independence Day | Closed | Closed |

| 10 | 27-Aug-2025 | Wednesday | Ganesh Chaturthi | Closed | Open |

| 11 | 02-Oct-2025 | Thursday | Mahatma Gandhi Jayanti / Dussera | Closed | Closed |

| 12 | 21-Oct-2025 | Tuesday | Diwali Lakshmi puja | Closed | Open |

| 13 | 22-Oct-2025 | Wednesday | Diwali Balipratipada | Closed | Open |

| 14 | 05-Nov-2025 | Wednesday | Gurunanak Jayanti | Closed | Open |

| 15 | 25-Dec-2025 | Thursday | Christmas | Closed | Closed |

The holidays falling on Saturday / Sunday are as follows:

| SL | Date | Day | Description |

| 1 | 26-Jan-2025 | Sunday | Republic Day |

| 2 | 06-Apr-2025 | Sunday | Shri Ram Navami |

| 3 | 07-Jun-2025 | Saturday | Bakri Eid |

| 4 | 06-Jul-2025 | Sunday | Muharram |

- A) Morning session

- Order entry & modification Time: 10 a.m. to 5:00 p.m

- B) Evening session

- Order entry & modification Time: 5:00 p.m. to 11:30 pm / 11:55 pm*

- * 5:00 pm to 9:00 pm / 9:30 pm for Agricultural Products with International Connections..

- ** *Muhurat Trading will be conducted on Tuesday, October21, 2025. Timings of Muhurat Trading shall be notified subsequently..

| Name of Bank Account | Bank Account Number | Bank Name | Branch | IFSC Code |

| Peerless Securities Limited - USCNB Account | 00080340003020 | HDFC BANK LTD | Stephen House | HDFC0000008 |

| Peerless Securities Limited - USCNB Account | 084010200016409 | AXIS BANK | Shyambazar | UTIB0000084 |

| Peerless Securities Limited - USCNB Account | 31059007098 | STATE BANK OF INDIA | SIB Branch Smriddhi Bhawan | SBIN0014524 |