Financial Products Distribution

Financial product distribution encompasses the methods by which various financial products like Mutual Funds, Insurance, NCD, Bonds, IPO and FDs investments are made available to customers. Peerless Securities as an Intermediary plays key role in this process, offering advice, sales, and support services. These products are distributed through channels like direct sales, associates and online platforms. Regulatory bodies ensure compliance with rules and standards to protect customers. Challenges include competition, evolving preferences, and regulatory complexities, but opportunities arise from technological advancements and market trends. Adaptation, innovation, and compliance are essential for effective distribution in this dynamic landscape. Effective distribution strategies, ethical practices, and technological innovation are essential for meeting the evolving needs of consumers and driving growth in the sphere of financial product distribution.

Form Downloadables

You can download all your FPD related Files, Forms and Documents here...

| Description | Download |

| About IRFC | |

| About NHAI Issue Highlights | |

| About PFC-Issue-Highlights | |

| IRFC Application Form 54Ec | Please mail us :fpd@peerlesssec.com or Call: +91 33 40502770 |

| NHAI 54Ec Application | Please mail us :fpd@peerlesssec.com or Call: +91 33 40502770 |

| PFC Application Form | Please mail us :fpd@peerlesssec.com or Call: +91 33 40502770 |

| REC Application Form | Please mail us :fpd@peerlesssec.com or Call: +91 33 40502770 |

Financial Product Distribution

Currency trading is the process of buying and selling currencies such as the US Dollar, the Euro, and the British Pound. Often called foreign exchange (forex) trading, it involves purchasing one currency while simultaneously selling another, with the aim of generating profits from currency movements. The International currency market involves participants from around the world. They buy and sell different currencies. Currency trading participants comprise banks, corporations, central banks (like RBI in India), investment management firms, hedge funds, retail forex brokers, and investors like you.

Way to Trade/Invest in PSL

Frequently Asked Questions

Currency derivatives are financial contracts between the buyer and seller involving the exchange of two currencies at a future date, and at a stipulated rate. Currency Derivatives Trading is suitable for those interested in reducing their foreign exchange rate risk. Currency Derivatives in India provide a bundle of opportunities for a number of players. Take this opportunity to effectively manage your international exchange rate risk with currency trading in India.

Mutual Fund Schemes are not guaranteed or assured return products. Investment in Mutual Fund Units involves investment risks such as trading volumes, settlement risk, liquidity risk, default risk including the possible loss of principal.

There are five main indicators of investment risk that apply to the analysis of stocks, bonds, and mutual fund portfolios. They are alpha, beta, r-squared, standard deviation, and the Sharpe ratio.

To start investing in a fund scheme you need a PAN, bank account and be KYC (know your client) compliant. The bank account should be in the name of the investor with the Magnetic Ink Character Recognition (MICR) and Indian Financial System Code (IFSC) details.

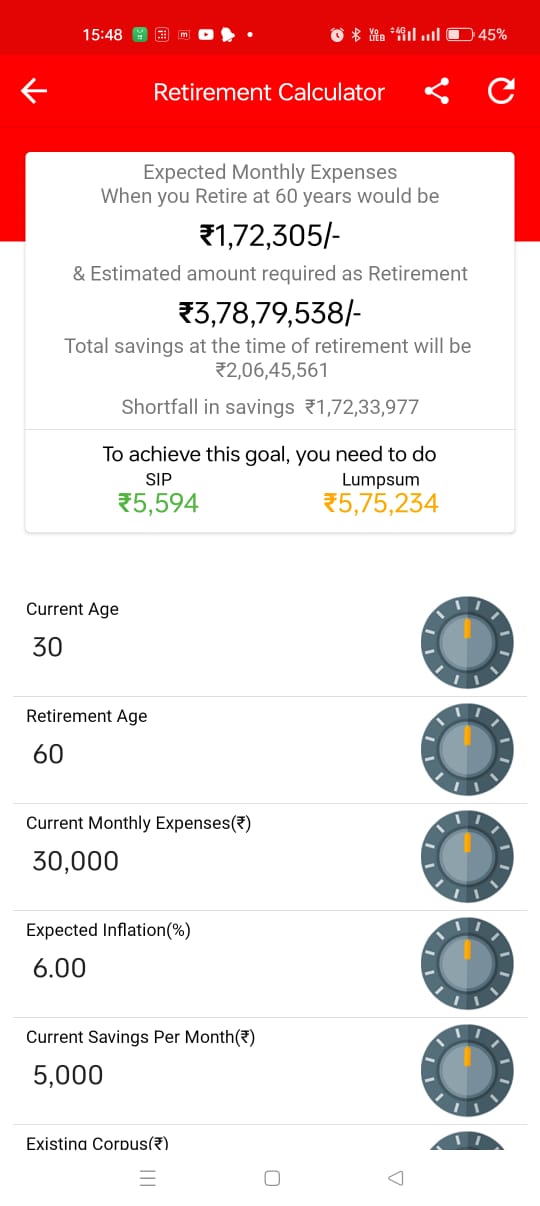

A Systematic Investment Plan (SIP), more popularly known as SIP, is a facility offered by mutual funds to the investors to invest in a disciplined manner. SIP facility allows an investor to invest a fixed amount of money at pre-defined intervals in the selected mutual fund scheme.

Mutual fund schemes could be 'open ended' or close ended' depending on its maturity period.

4 Pillars of Successful Long Term Investment:

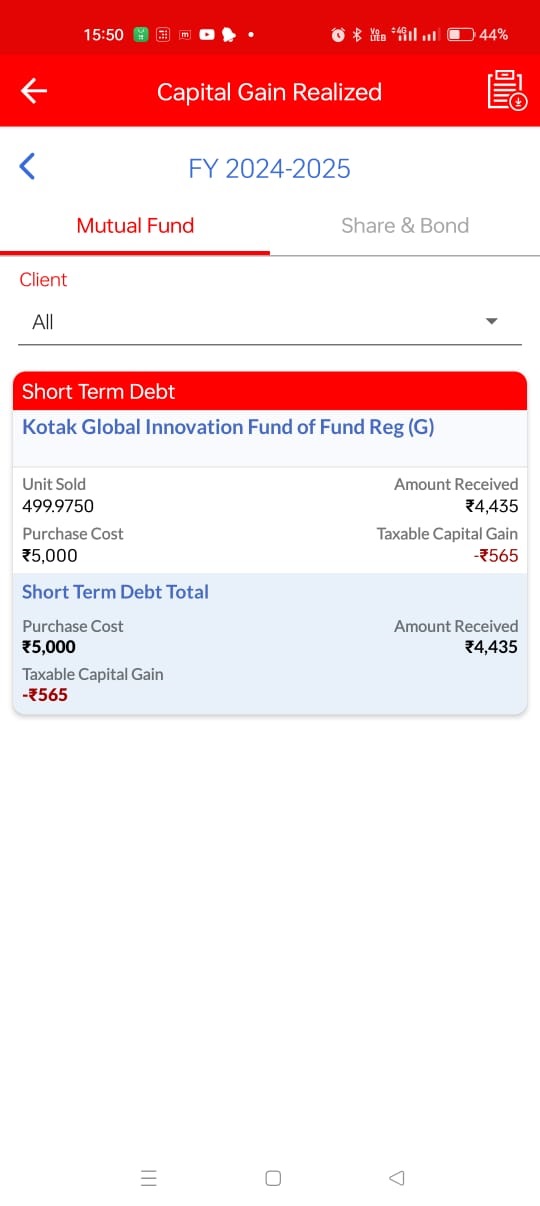

- Tax Efficient Investments – The investment management market emphasizes on total investment returns before taxes, and generally does not focus on the more important after-tax returns.

- Low Expense Ratio.

- Asset Allocation Strategy.

- Diversification & liquidity.

- Planning

- Patience

- Performance

- Persistent

You will need a Permanent Account Number (PAN) and a bank account. You also need to complete your CKYC, or Central Know Your Customer process. Further, you also need to submit the FATCA form or complete it online.

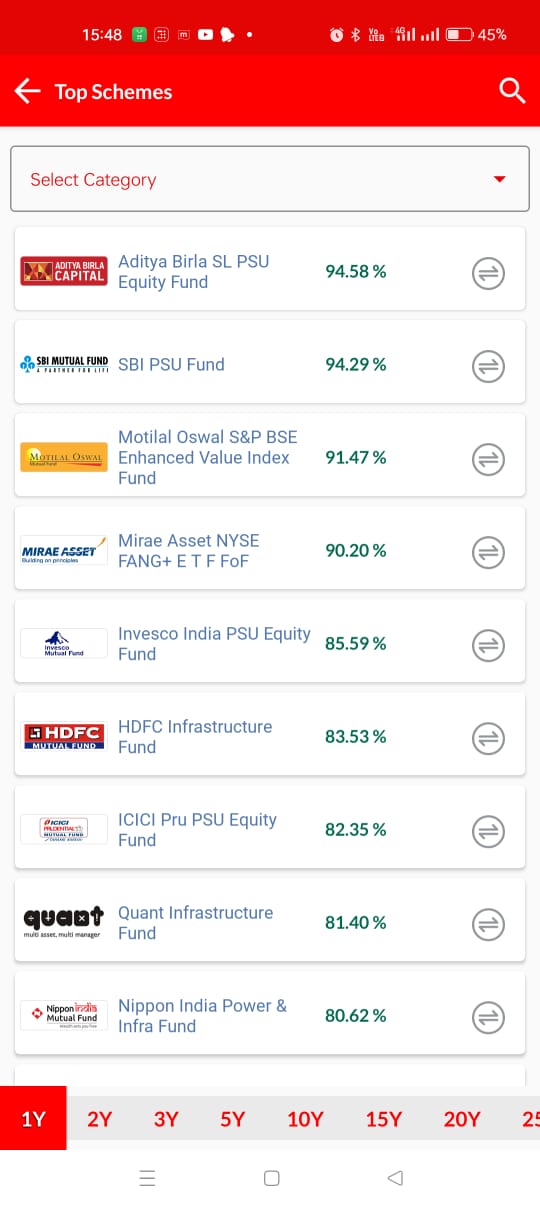

Mutual funds offer diversification or access to a wider variety of investments than an individual investor could afford to buy. There are economies of scale in investing with a group. Monthly contributions help the investor's assets grow. Funds are more liquid because they tend to be less volatile.

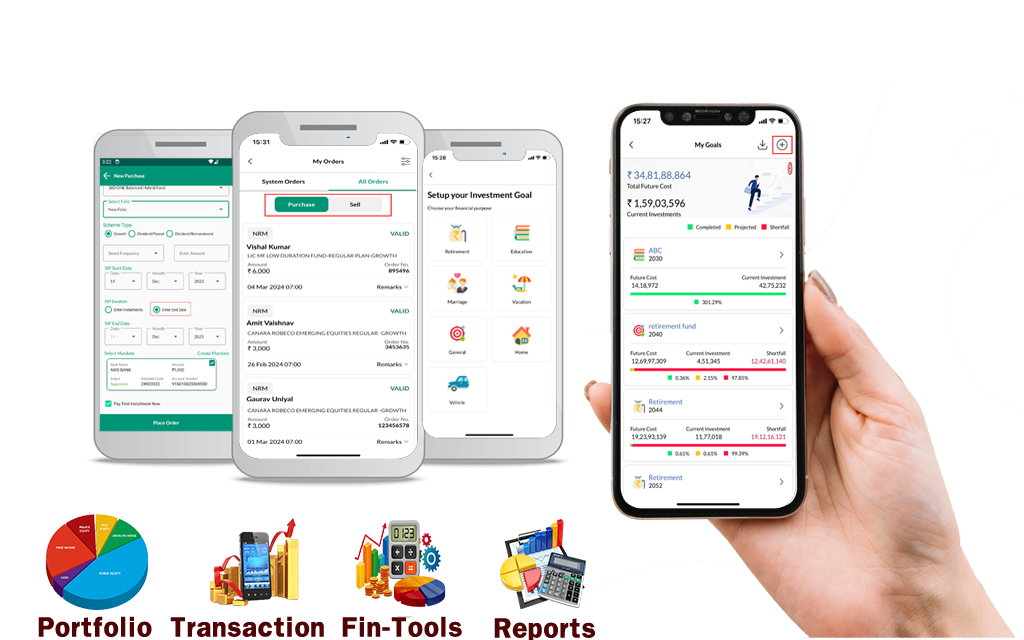

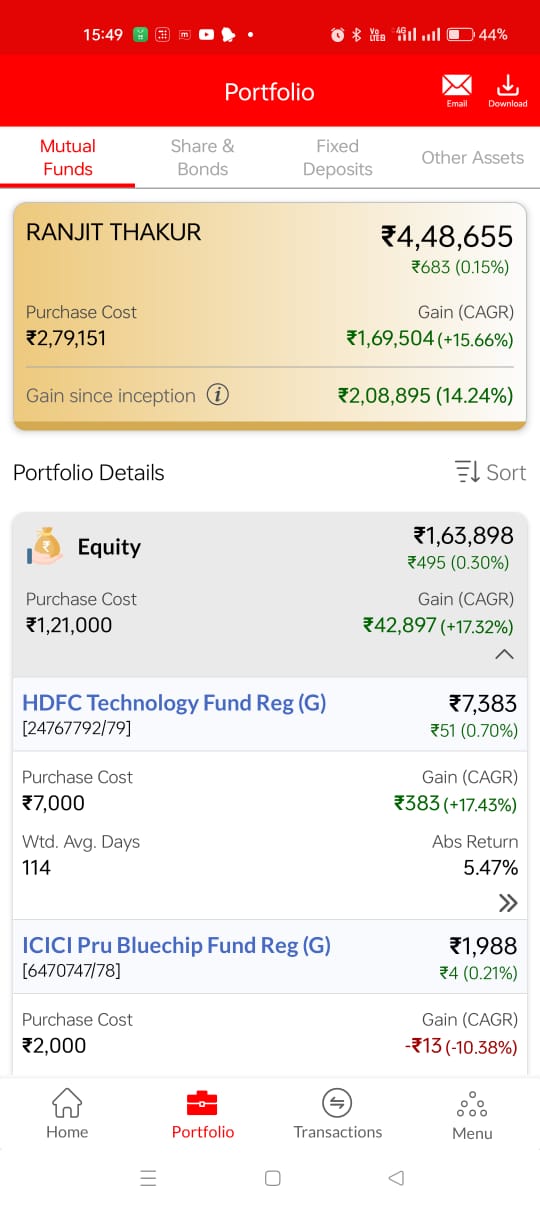

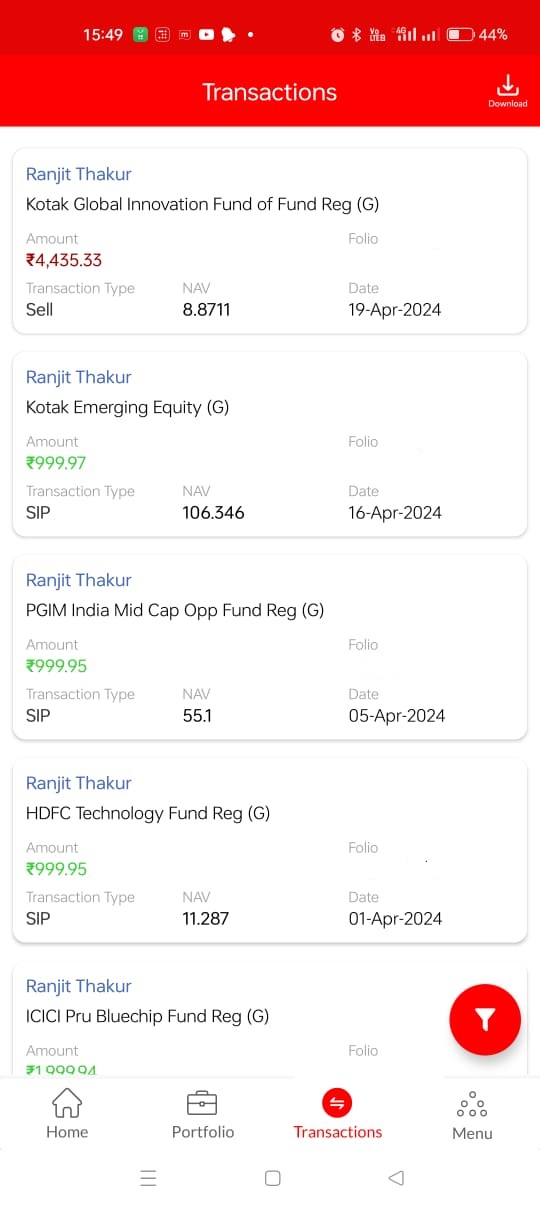

You will get sort of Marketing Support from PEERLESS SECURITIES LTD.Oline platform to all associate and their clients to keep a track on the portfolio.Simple transaction and payment process.Backoffice support to check multiple reports.

Mr. PiP Gallery

MR-PiP is a gen Z mobile app currently available in Android.