What we Offer

Essentially, a depository participant means a place that resembles a bank that stores money and conducts transactions. Instead of money, a depository participant acts as a store of assets such as securities. Peerless Securities Ltd (PSL), as a Depository Participant (DP) offers a seamless, safe & convenient way to hold securities in electronic form as compared to paper form. It offers freedom from delays, forgeries, settlement risk and paper work. In line with its commitment of providing highly evolved products and prompt services. PSL is a registered Depository Participant with National Securities Depository Limited (NSDL).The emergence of the depository system in India has revolutionized the trading industry, making transactions quicker, safer, and more efficient. At PSL, we offer you the convenience of this system right at your fingertips.

Automated pay-in facility to clients.

Reduced transaction costs.

Digital On-boarding Process and facility to transact online.

Trustworthy and reliable.

Dedicated Relationship Manager and effective Customer centric support.

Nominate your loved ones at your fingertips.

Depository Participant

A Depository Participant is described as an Agent of the depository. They are the intermediaries between the depository and the investors. The relationship between the DPs and the depository is governed by an agreement made between the two under the Depositories Act. Be part of Peerless Extended Family by opening an account with us.

Instant A/c Opening

🚀 Open your Trading/Demat Account in minutes in PSL

eKYC—hassle-free & paperless! 💼

Steps to open an Account

Opening an account with us is both simple and straightforward. Our streamlined process ensures you can get started on your financial journey with ease. Just follow the steps, and you'll be ready to enjoy our comprehensive services in no time.

Pricing and Charges Details

Depository Participant (DP) charge is levied by the depository, i.e., National Securities Depository Limited (NSDL), and Depository Participant (DP), i.e., Peerless Securities (PSL), when shares are sold from the demat account. The charge is imposed by NSDL and by PSL) + 18% GST and is applicable per day and per stock, regardless of the quantity sold.

| Charges Head | Charges Details |

| Account_Maintenance | 650/- per Financial Year for non BSDA categories plus NSDL charges, if any. BSDA (For other than Debt securities)-No AMC till holding value Rs. 50,000 ; Rs100/- per financial year for holding value between Rs. 50,001 and Rs. 2,00,000 and if crossed within financial year will be charged regular AMC. BSDA (For Debt securities)-No AMC till holding value Rs. 100,000 ; Rs100/- per financial year for holding value between Rs. 100001 and Rs. 2,00,000 and if crossed within financial year will be charged |

| Demat | 2/- per cert. Min ` 500/- per request |

| Remat | 12/- per cert. Min ` 500/- plus NSDL charges |

| Transaction_Debit | Non- BSDA Category Clients- 15/- for intra DP, 21/- for inter DP, 12/- for instruction delivered through Speed-e. BSDA Category Clients- 0.5% of the value of the txn subject to min Rs50/- in all modes of transaction |

| Pledge_Creation | 35/- per creation |

| Pledge_Creation_Confirmation | NIL |

| Pledge_Closure | 15/- per closure |

| Pledge_Closure_Confirmation | NIL |

| Pledge_Invocation | NIL |

| Margin Pledge Charges | 15/- for creation/closure/invocation, 6/- for Repledge by TM to CM/CC or release by CM/CC to TM |

| NDU_Charges | NIL |

| Failed_Instruction_Charges | 20/- for each erroneous/failed/rejected transaction |

| Other_Charges | Charges for Demographic detail change for Non-BSDA Clients- 50/- and BSDA Clients-100/-; Transmission charges `. 250/-; Speed-e Maintenance charges per F.Y: `. NIL for password users, `. 200/- plus NSDL charges for e-token users, Cq dishonour charges `. 250/-, DI book- ` 20/- (except the first one), Late submission for same day Pay-In is ` 20/- per transaction |

| IDeAS | Free to all clients |

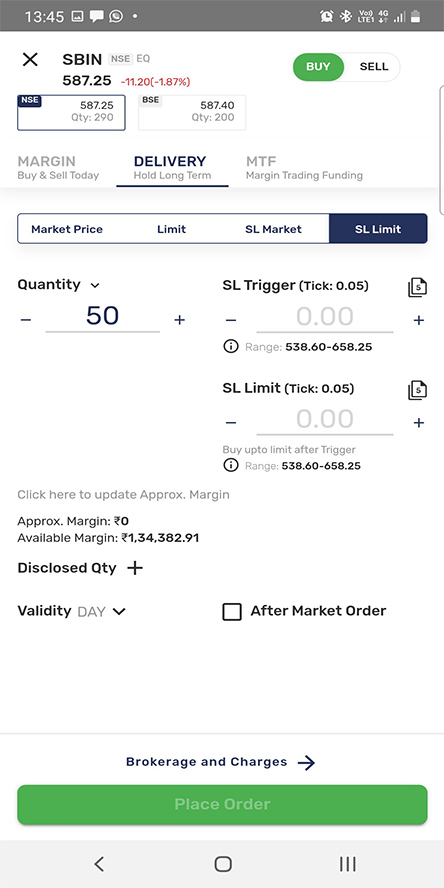

Way to Trade/Invest in PSL

Frequently Asked Questions

Explore our Frequently Asked Questions to find answers to common queries about our services, account management, and trading processes. Whether you're curious about account opening procedures, fee structures, or technical support, our FAQs provide clear and concise information to help you navigate your trading journey seamlessly. If you have specific questions not covered here, our support team is always ready to assist you further.

Account Opening process link

Yes, a trading and demat account can be opened with PSL even if there are accounts with other brokers with the same PAN that may or may not be active. The PAN enables Indian regulatory authorities to identify the investments linked to their owners, irrespective of the number of demat accounts they own.

Providing bank account details at the time of demat account opening is mandatory. These bank details are communicated to issuer companies / RTAs for the purpose of crediting any amount payable to you (such as dividend, interest or maturity payment or redemption amount) directly in your bank account. It is therefore suggested that you provide details of your active bank account in the account opening form. Later, in case of change therein, please remember to inform to your DP.

In order to dematerialize certificates, you need to open a demat account. Once the demat account has been opened, you need to fill up a 'Dematerialization Request Form' in prescribed form and submit it to your DP along with the security certificates. Your DP will forward the demat request to the concerned issuer company or its Registrar and Transfer Agent for further processing. Once the request is confirmed by the concerned issuer company or its Registrar and Transfer Agent, it results in credit of electronic securities in the demat account of the respective investor.

Nomination is not mandatory for demat account. However, it is very much recommended to have nominee mentioned in the demat account. In the unfortunate case of death of sole account holder, it makes the process of transmission very easy and fast. In case you do not wish to mention any nominee at the time of account opening, you are required to state that ''I/We do not wish to make a nomination'' and submit a declaration in prescribed format as per sebi guidelines.

Delivery Instruction Slips are similar to your bank account cheque book. You should take care of following points in respect of DIS -

- Ensure that you receive DIS book from your DP. Do not accept loose slips (unless required so in urgent situations).

- Ensure that each DIS is pre-printed and serially numbered.

- Ensure that your Client ID is pre-stamped or pre-printed on each DIS.

- Do not leave your DIS with anyone else. Fill it and hand it over to your DP when you need to do so.

- Keep your DIS book safely. In case you happen to lose or misplace any slip or booklet, please inform your DP immediately in writing.

- If DIS has place (lines) to mention more than one instruction and you are not using all of them, then please remember to strike out the unused lines / space before handing it over to your DP to prevent misuse by any.

- Please ensure that the instruction slip is duly filled in with all required details and signed by all the joint holders before handing it over to your DP.

- Date of payment.

- Mode of payment (cash, cheque or electronic payment).

- In case mode of payment is cheque or electronic payment, transferee's name, bank account number, bank name, transaction reference number for electronic payments or cheque number for cheque payments are required.

- All debit transfers

- Credits for IPO, sub-division and bonus

- Failed instructions

- Overdue instructions

- Change of mobile number

- Change of address

- Debit of mutual fund units

- Registration and de-registration of Power of Attorney

- Modification, cancellation / deletion of nominee name

- Pledge initiation, confirmation and invocation (to pledgor)

- Blocking of and debit of shares in respect of tender offer instruction.

- For change of address, registration and de-registration of DDPI in depository system, SMS alerts are sent to registered mobile phone irrespective of whether account holder has opted for this facility or not.

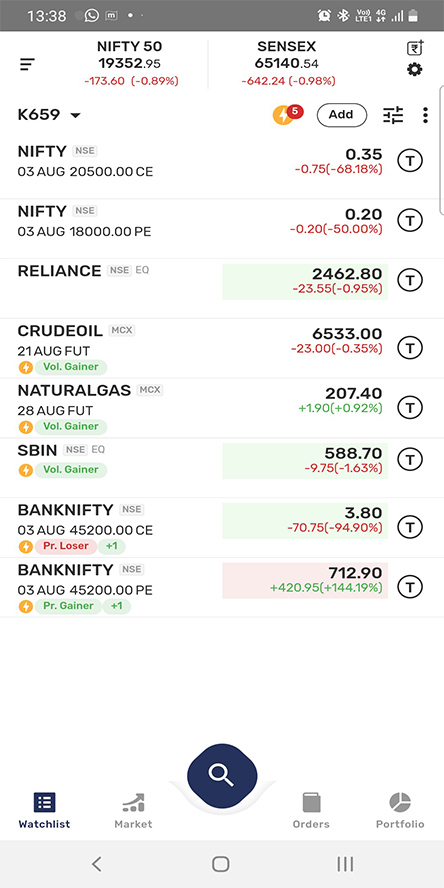

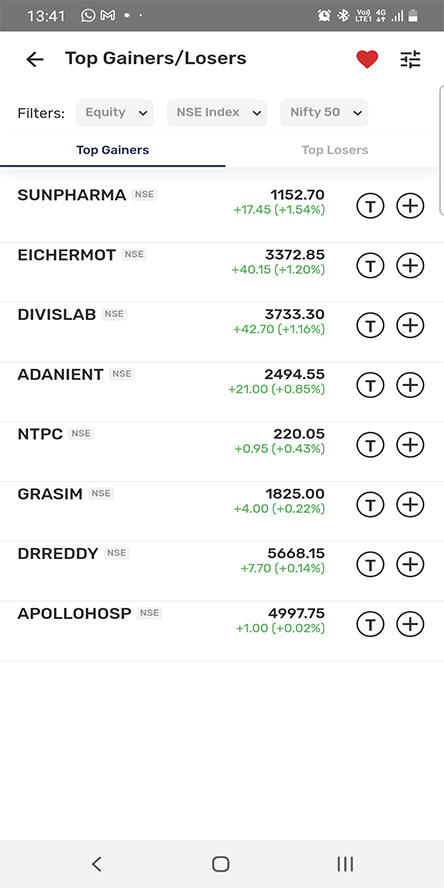

PSMART Gallery

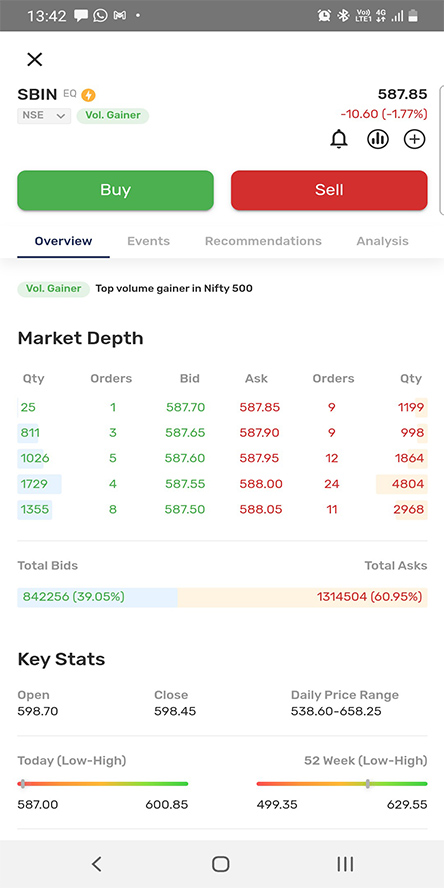

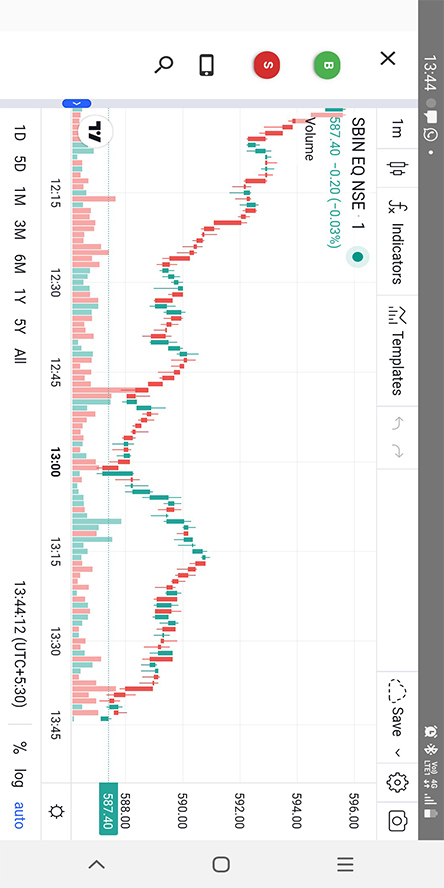

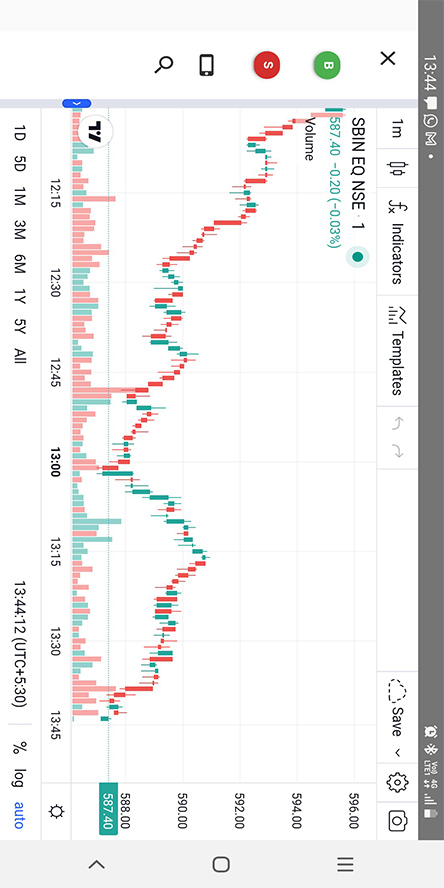

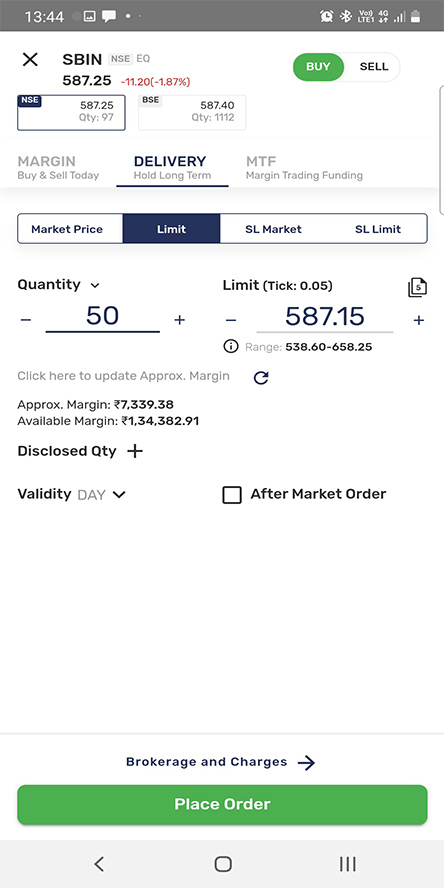

The PSMART Photo Gallery is a showcase of our latest innovations and user-friendly features designed to elevate your trading experience. Explore visually engaging snapshots of our customizable dashboards, advanced charting tools, and real-time market analytics. Each image captures the essence of our platform's intuitive design and comprehensive functionality, offering a glimpse into how PSMART empowers traders with seamless navigation and powerful tools. Join us in exploring the future of trading technology through the lens of the PSMART Photo Gallery.

Peerless Securities has partnered with  for its charting technology. A comprehensive trading platform offering market data and analytical tools like stock screeners and economic calendar to track key financial events.

for its charting technology. A comprehensive trading platform offering market data and analytical tools like stock screeners and economic calendar to track key financial events.