Inside Central Dealing Desk

Welcome to your ultimate trading companion - our Central Dealing Desk. Whether you're a seasoned investor or just starting out, our dedicated team is here to navigate you through the complexities of the market. Experience unparalleled support and make informed decisions with ease.

Dial: +91 33 6813 5000

CDD Call n Trade

Execute trades effortlessly with our 6-step guide! From dialing to our centralised number 6813 5000 to order placement, we've simplified the process for you. Gain confidence and maximize your potential returns. Start trading smarter today!

Here’s how you can complete your Trading in CSD

Dial +91 33 6813 5000

Connect to Dealer

Authorization

Instruction to Dealer

Execute Trades

Trade confirmation

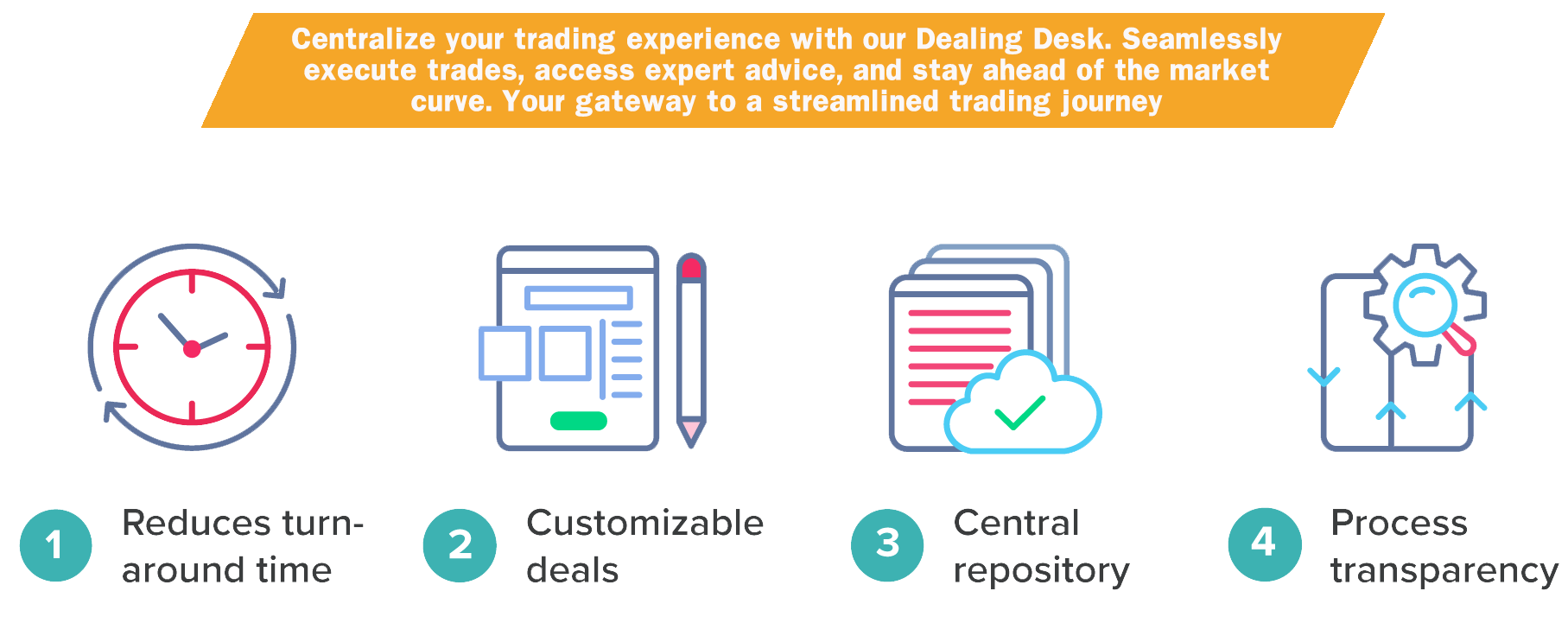

Advantages of our CDD Desk

Central Dealing Desk: The Hub of Trading Excellence. Precision in Every Transaction. Where Markets Converge for Success.Central dealing desks offer streamlined access to various markets, consolidating trading activities in one centralized location. This setup enhances efficiency by providing traders with a single point of contact for executing trades across multiple asset classes. Moreover, central dealing desks often leverage advanced technology and expertise to optimize trade execution, leading to improved pricing and reduced execution risks. Additionally, these desks facilitate better risk management and compliance monitoring, ensuring adherence to regulatory requirements and internal policies.

Access to Expertise

Clients gain access to experienced traders and market experts who can provide valuable insights, guidance, and execution support. This expertise can help clients make informed trading decisions and navigate complex market conditions more effectively.

Improved Execution Quality

Clients benefit from improved execution quality, including better prices, reduced slippage, and faster order fulfillment.

Risk Management Support

CDDs provide clients with risk management support, including real-time monitoring of market positions, exposure analysis, and hedging strategies. Clients can mitigate risks effectively with the guidance and expertise of CDD professionals.

Efficient Order Handling

Clients benefit from streamlined order handling processes and efficient trade execution through CDDs. With dedicated trading desks managing their orders, clients can enjoy faster execution times, reduced administrative burdens, and greater transparency throughout the trading process.

Enhanced Liquidity

CDDs can offer access to deeper market visibility, enabling clients to execute trades across segments and exchanges.

Tailored Solutions

Central Dealing Desks can customize solutions to meet the specific needs and objectives of individual clients. Whether clients require to get update about holding,ledger balance, particular markets' information. CDDs can tailor solutions to suit their requirements.

Regulatory Compliance

CDDs ensure compliance with regulatory requirements, safeguarding clients' interests and investments. By adhering to regulatory standards and best practices, CDDs help clients mitigate regulatory risks and maintain regulatory compliance in their trading activities.

9to12 Support

CDDs offer support to clients, providing assistance and guidance whenever needed during market hours. This ensures that clients have access to support and resources whenever they require assistance with their trading activities.

Peerless Securities has partnered with  for its charting technology. A comprehensive trading platform offering market data and analytical tools like stock screeners and economic calendar to track key financial events.

for its charting technology. A comprehensive trading platform offering market data and analytical tools like stock screeners and economic calendar to track key financial events.